Real-time news APIs can transform your crypto trading strategy. They deliver instant updates, analyze market sentiment, and even automate trading decisions - all in a market that never sleeps. Here's how they help:

- Faster Decisions: Get breaking news in seconds, giving you an edge over slower sources.

- Sentiment Analysis: Understand market mood - positive or negative news often drives crypto prices.

- Automation: Link APIs to trading bots to act on news immediately, reducing delays and emotional bias.

- Custom Feeds: Filter updates by keywords, cryptocurrencies, or sources to avoid information overload.

- Backtesting: Test strategies using historical news data to refine your approach before trading live.

In a market as volatile as crypto, real-time news APIs are essential for spotting opportunities, managing risks, and staying ahead of the competition.

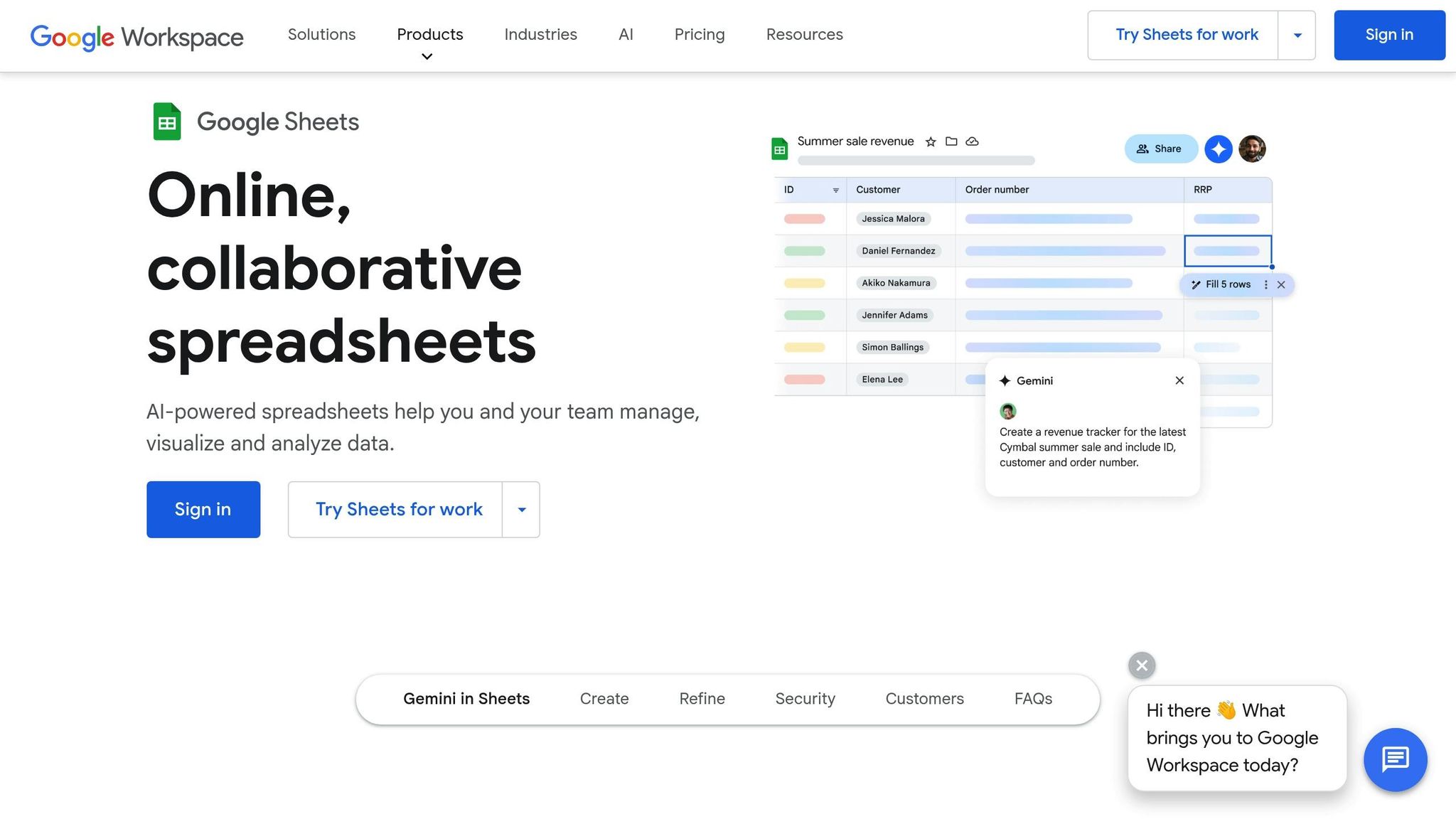

How To Get Crypto News Data Into Google Sheets Using A Free API

How Real-Time News APIs Improve Trading Results

Real-time news APIs are transforming crypto trading from a reactive process into a proactive strategy. These tools provide traders with early access to critical information, sentiment insights, and the ability to automate responses. In the fast-moving and unpredictable crypto market, these advantages can lead to more informed and timely trading decisions.

Spot Market Opportunities Before Others

In crypto trading, speed can make all the difference. Real-time news APIs deliver breaking updates within seconds, giving traders a distinct advantage over those relying on slower, traditional sources. By aggregating content from multiple outlets, these APIs provide a comprehensive view of market developments in real time. Instead of manually monitoring various platforms, traders receive curated updates tailored to their specific needs.

For instance, traders can customize their news feeds to focus on particular keywords, cryptocurrencies, or sources, ensuring they only see relevant updates. This helps avoid information overload while highlighting price-moving events before the broader market reacts. A trader interested in Ethereum, for example, could configure their API to prioritize news about regulatory updates, network upgrades, or major partnerships. Additionally, these APIs offer early warnings about potential market shifts, allowing traders to adjust their positions or exit trades before panic selling takes hold. This streamlined, real-time information flow is a game-changer for sentiment-based predictions.

Use Sentiment Analysis for Better Predictions

Sentiment analysis takes raw news and transforms it into actionable insights by measuring market sentiment from sources like social media, news articles, and online forums. Positive sentiment often drives prices up, while negative sentiment can trigger declines. By analyzing these trends, traders can refine their strategies and better manage risk.

The crypto market’s sensitivity to social influences makes sentiment analysis especially valuable. A single tweet or project announcement can significantly impact prices. Here are some tools and techniques that enhance sentiment tracking:

- Sentiment Indices: Tools like the Fear & Greed Index and Nansen combine factors like trading volume, social media activity, and volatility to provide snapshots of market sentiment.

- Social Media & API Analysis: Platforms like Twitter and Reddit, along with APIs like Google Trends, offer insights into public mood and market sentiment.

- On-Chain Analysis: By tracking transaction volumes, wallet activity, and network growth, this method provides additional data to inform trading strategies.

Some sentiment analysis APIs even offer historical social data dating back to 2017 for over 1,000 cryptocurrencies. This allows traders to backtest sentiment-based strategies and understand how emotional patterns have influenced past price movements. Savvy traders often combine sentiment analysis with technical and fundamental data, staying mindful of the risks of data manipulation and focusing on reliable sources.

When paired with automated trading systems, sentiment analysis becomes even more powerful, enabling traders to act on insights with lightning speed.

Connect News APIs to Automated Trading Bots

Automated trading bots bridge the gap between receiving news and executing trades. By linking real-time news APIs directly to trading systems, traders can react to market-moving events in milliseconds, a far cry from the delays of manual trading. Setting up this automation involves three main steps: sourcing reliable news, quantifying sentiment, and deploying the bot on a platform that supports automated trading. Advances in AI and natural language processing have simplified this process, making it accessible even to those with minimal coding knowledge.

Today, no-code tools make it easier than ever to create automated trading setups that integrate news feeds, sentiment analysis, and execution platforms. For those just starting, simplicity is key - beginning with a basic setup and gradually refining it through testing can yield better results. Backtesting strategies with historical data is crucial to ensure the model performs well before risking actual funds. Regularly monitoring bot performance, including trade history and execution speed, helps maintain efficiency.

During periods of high volatility, automation proves especially valuable. Manual trading often struggles to keep up with rapid market changes, whereas bots can execute trades with low latency. Many traders now use AI agents as a user-friendly interface for creating responsive bots, whether they’re hobbyists or experienced algorithmic traders. This combination of speed, simplicity, and adaptability is reshaping how traders approach the crypto market.

Common Problems with News-Based Trading

Real-time news APIs have become a powerful tool for crypto trading, offering traders valuable insights and opportunities. But they’re not without challenges. To make the most of these tools, traders need to navigate a few key hurdles effectively.

Managing Too Much Information

One of the biggest headaches? Information overload. News analytics tools churn through mountains of unstructured data using natural language processing, sentiment analysis, machine learning, and AI. While these tools are designed to deliver insights, the sheer volume of data can overwhelm even the most seasoned traders if not managed properly.

The solution? Fine-tuning and filtering. Traders can customize their algorithms to focus on specific news sources, cryptocurrencies, or events that align with their strategies. For instance, platforms like Google News or Feedly allow users to set up targeted keywords such as "cryptocurrency" or "blockchain" to cut through the noise. More advanced users can go a step further by setting detailed preferences for sources and keywords, creating a more tailored and actionable news feed.

AI tools can also simplify this process. As TradingView News puts it:

"ChatGPT can simplify and accelerate crypto analysis by interpreting market data, summarizing sentiment and generating strategy templates".

However, the quality of these tools depends heavily on how you use them:

"The quality of your prompts defines the quality of insights you'll get".

For example, refining your queries - like asking for a buy/sell signal with a confidence score - can help you get actionable outputs that align with your trading goals.

Avoiding False or Misleading News

Another major challenge is distinguishing reliable news from misinformation. The crypto market is particularly vulnerable to rapid price swings caused by false or manipulated information. Acting on inaccurate news can lead to costly mistakes, so verifying the accuracy of information is crucial.

Start by thoroughly vetting your sources. Vertical reading - checking the credibility of a source by assessing its transparency and potential biases - is a good first step[20, 21]. Lateral reading, which involves cross-referencing information with multiple reputable sources and using fact-checking tools, adds an extra layer of validation[20, 21]. If you’re dealing with video content, opt for unedited footage over curated clips to get the full context.

Watch out for sensational headlines. They’re often designed to provoke strong reactions and may not reflect the actual story. While verifying news is critical, speed also plays a role in trading success. Balancing accuracy with timeliness is key.

Dealing with Speed and Access Issues

Even with the right data and reliable news, speed is everything in crypto trading. Milliseconds can be the difference between profit and loss. That said, fast access to news data shouldn’t come at the expense of reliability. API performance becomes especially important during high-volatility periods when trading volumes spike and breaking news floods the market. Unfortunately, some APIs may experience delays or outages at critical moments. To minimize this risk, consider using multiple API sources and setting up fallback systems that automatically switch providers during disruptions.

Reducing latency requires more than just picking a fast API. Every part of your infrastructure plays a role, from your internet connection to your trading platform. Cloud-based solutions often provide more stable connectivity and lower latency during peak trading hours. Regularly monitoring data quality - such as comparing timestamps and setting up automated alerts for unusual delays - can help ensure your news feeds remain both timely and accurate. Having redundancy measures in place can also safeguard your trading operations during technical hiccups in high-stakes moments.

sbb-itb-00c75f7

AIQuant.fun: Real-Time News Integration in Action

AIQuant.fun tackles the challenges of crypto trading by leveraging cutting-edge AI tools that integrate real-time news APIs. This approach ensures traders can make data-driven decisions without falling prey to information overload or misleading news. By combining advanced sentiment analysis with seamless trading execution, the platform equips users to fine-tune their strategies at every stage - from assessing market sentiment to automating trades.

Real-Time Sentiment Analysis for Better Trades

AIQuant.fun uses autonomous AI agents to analyze a wide range of data streams, including news feeds and Alpha Liquid Terminal datasets. These agents assess market sentiment and identify trading opportunities beyond basic price data, offering users a deeper understanding of market dynamics.

Instead of manually sorting through endless news articles, users can rely on the platform’s natural language processing capabilities to detect sentiment shifts that might influence cryptocurrency prices. By integrating news sources, social media feeds, and market data, the platform delivers a comprehensive snapshot of market conditions in real time.

One standout feature of AIQuant.fun is its ability to eliminate emotional bias, a major hurdle in news-based trading. As the platform explains:

"AIQuant provides autonomous AI agents for retail traders that analyze markets, execute technical analysis, and automate trades without emotional bias. Our adaptive agents work continuously across multiple data streams, giving individuals institutional-level trading capabilities previously unavailable to retail investors".

This objectivity ensures that trading decisions remain consistent, even during volatile market conditions when human traders might react emotionally or make impulsive choices.

AI Trading Agents That Use News Data

AIQuant.fun takes sentiment analysis a step further by enabling its agents to act on insights automatically. Users can customize these AI agents to respond to specific news events, sentiment thresholds, or market conditions, aligning with their unique trading goals.

For example, a trader could configure their agent to increase positions when positive regulatory news emerges for a cryptocurrency or to implement protective stops when negative sentiment hits a critical level. Operating around the clock, these agents ensure that no trading opportunity slips through the cracks.

Marlon Williams, the founder of AIQuant.fun, highlights the platform's innovative approach:

"AIQuant.fun is committed to pushing the boundaries of what's possible in decentralized finance, and this partnership with Alpha Liquid Terminal is a major step forward. Together, we are not just simplifying access to DeFi but also creating smarter, more automated solutions for users around the world. By integrating autonomous AI agents and gamified financial growth, this collaboration strengthens our vision of building a truly open and efficient financial ecosystem".

These AI agents execute sophisticated, data-driven trading strategies by combining news sentiment, technical analysis, and market conditions. This multi-layered approach ensures users can capitalize on opportunities that might go unnoticed when relying on single data sources.

Test News-Based Strategies with Historical Data

AIQuant.fun also offers a backtesting feature, allowing users to test news-based strategies with historical data - a critical tool for refining crypto trading approaches.

With this functionality, traders can simulate how their AI agents would have performed during past market events, including major news-driven price swings. By experimenting with different sentiment thresholds, news source combinations, and reaction times, users can fine-tune their strategies before risking real funds.

This feature also helps identify weaknesses in trading strategies. For instance, users might learn that their agent reacts too quickly to certain news, triggering false signals, or that it lags behind on crucial market shifts. By incorporating both price and sentiment data into historical simulations, AIQuant.fun provides a realistic testing environment.

Additionally, the backtesting process accounts for real-world trading conditions, such as fees and slippage, ensuring performance metrics like total returns, win rates, and maximum drawdowns are grounded in reality. This thorough testing approach helps traders avoid overfitting strategies to historical data while building confidence in their automated systems before deploying significant capital.

The Future of News-Driven Crypto Trading

Crypto markets are known for their lightning-fast pace, and staying ahead often means having access to real-time news. Toishaa Soni, a Content Writer and Crypto & Blockchain Analyst, emphasizes this shift:

"Real-time news is no longer a luxury but a necessity for everyone. From faster decisions and improved risk management, the ability to access live information has changed the way we analyze and interact with financial data."

This growing reliance on instant information reflects a significant change in how traders approach the market. In fact, 55% of U.S. crypto holders now monitor crypto markets more frequently than traditional financial markets. These trends hint at a future where real-time data continues to redefine how crypto trading operates.

Key Advantages of Real-Time News APIs

Real-time news APIs have become a game-changer for traders. They deliver immediate insights, simplify complex data into actionable intelligence, and support automation that helps remove emotional decision-making from the equation. In a market where a single news event can trigger drastic price swings within seconds, having the ability to act quickly is crucial. Automated trading systems, powered by these APIs, enable investors to adapt to market shifts instantly, particularly during volatile periods, while minimizing emotional interference.

The Next Frontier in News Integration

Looking ahead, the integration of advanced technologies with real-time news promises to take crypto trading to new heights. One of the most exciting developments is AI-driven sentiment analysis. By leveraging natural language processing, these tools can evaluate the tone and intensity of content from social media, financial news, and online forums. This allows traders to identify hidden patterns and improve the accuracy of their decision-making by filtering out irrelevant noise.

Predictive modeling is another game-changer. For example, when web search functionality launched in May 2025, AI-related tokens like Fetch.ai (FET) and SingularityNET (AGIX) experienced immediate price reactions, showcasing how predictive tools can influence market behavior.

Regulatory technology (Regtech) is also transforming the landscape. In April 2025, the SEC introduced new guidelines requiring smart contract codes that define investor rights to be filed - and updated filings made when changes occur. This move places greater accountability on developers and adds a layer of compliance to the crypto ecosystem.

Additionally, the integration of blockchain with news APIs is set to enhance both transparency and security. By combining AI with blockchain, these systems aim to improve intelligence, accessibility, and trust.

With 92% of U.S. crypto holders optimistic about blockchain's potential to modernize the economy, it's clear that innovation in news-driven trading tools will continue to evolve. As the crypto market matures, traders who adopt these cutting-edge technologies are poised to stay ahead of the curve and lead the way forward.

FAQs

How can I avoid information overload when using real-time news APIs for crypto trading?

Managing the flood of information from real-time news APIs is crucial for making smart decisions in crypto trading. The first step? Filter and prioritize your news sources. Stick to trusted outlets that deliver updates relevant to your trading strategy. Set up alerts for critical events - like significant price shifts or major market announcements - so you can react promptly without drowning in irrelevant data.

To keep things organized, consider using custom dashboards. These can display only the metrics and data points that truly matter to you, cutting through the noise and making decision-making more efficient. Another helpful tip is maintaining a trading journal. Logging your trades, along with your thoughts and emotions, can help you identify patterns in your behavior and refine your strategy over time. By streamlining your process, you’ll be better equipped to make clear, data-driven choices without the stress of information overload.

How can I ensure the news I rely on for crypto trading is accurate and trustworthy?

When it comes to using news for crypto trading, it's essential to stick with reliable and well-known sources. Established cryptocurrency news platforms and respected financial publications are great places to start. Always make it a habit to cross-check the information with multiple sources to ensure accuracy before acting on it.

Be wary of social media posts or celebrity endorsements - they can often be deceptive or even part of scams. Familiarize yourself with common warning signs in the crypto world, and consider joining trusted forums or communities where seasoned traders share their experiences and insights. This approach can help you sift through misinformation and make more informed trading choices.

How can sentiment analysis tools improve trading decisions in the unpredictable crypto market?

Sentiment analysis tools are a game-changer for traders trying to navigate the often volatile cryptocurrency market. By examining data from platforms like social media, news outlets, and forums, these tools provide insights into how the public feels about specific cryptocurrencies. A positive sentiment can indicate a potential price increase, while negative sentiment might hint at a possible decline. This kind of information helps traders make better-informed decisions.

The most advanced tools, particularly those powered by AI, go a step further by identifying patterns in investor discussions and even predicting trends. With the ability to quickly respond to shifts in sentiment, traders can stay ahead of the curve and adjust their strategies to match the fast-paced crypto market.