Want to predict cryptocurrency market swings more effectively? Sentiment analysis tied to specific events might be the answer. Here's what you need to know:

- Event-specific sentiment analysis focuses on how news or events impact investor behavior, outperforming general sentiment analysis for crypto markets.

- Machine learning models using sentiment data improve forecasting accuracy by 54.17%. Negative sentiment often spikes volatility, while positive sentiment can stabilize markets.

- Four approaches - AIQuant.fun, VADER, BERT-based models, and SVM - offer different strengths for integrating sentiment data into trading strategies.

Quick Takeaways:

- AIQuant.fun: Combines AI-driven sentiment analysis with automated trading for real-time market reactions.

- VADER: Processes social media sentiment quickly but struggles with crypto-specific slang.

- BERT-based models: Highly accurate for nuanced language but slower for real-time use.

- SVM: Balances speed and accuracy but requires manual updates for crypto terms.

Bottom Line: The best method depends on your trading goals. High-frequency traders may prefer VADER, while long-term investors might lean on BERT. AIQuant.fun offers a user-friendly mix, and SVM provides a middle ground between simplicity and precision.

Cryptocurrency Price Prediction using Twitter Sentiment Analysis

1. AIQuant.fun

AIQuant.fun merges AI-powered trading with event-specific sentiment analysis to predict market volatility. Its autonomous trading systems process sentiment data in real-time, making it especially effective in the fast-paced cryptocurrency markets, where price swings often stem from sudden events.

Precision in Sentiment Analysis

AIQuant.fun showcases its capabilities with impressive metrics: 38,257 trades, a trading volume of $16,746,739.06, and sentiment analysis spanning 285 tokens. These numbers underscore the platform's ability to deliver consistent results.

What truly sets AIQuant.fun apart is its commitment to objective sentiment interpretation. Unlike human traders, its AI agents maintain steady analytical standards, even when faced with conflicting sentiment signals during significant crypto events.

Tailored for Crypto-Specific Events

The platform's AI agents are trained to recognize patterns unique to the cryptocurrency market. They are equipped to handle the complex language and context surrounding crypto-related events, ensuring accurate sentiment analysis. Additionally, its support for multichain trading allows it to track sentiment across various blockchain ecosystems seamlessly.

Always-On, Real-Time Monitoring

AIQuant.fun operates around the clock, scanning news, social media, and market data to detect sentiment changes as they happen. This ensures that no critical shift goes unnoticed.

Seamless Trading Integration

By combining sentiment analysis with automated trading strategies, AIQuant.fun minimizes delays between identifying sentiment shifts and executing trades. The platform also offers tools for strategy tuning and backtesting, making it a powerful choice for traders looking to navigate sentiment-driven volatility.

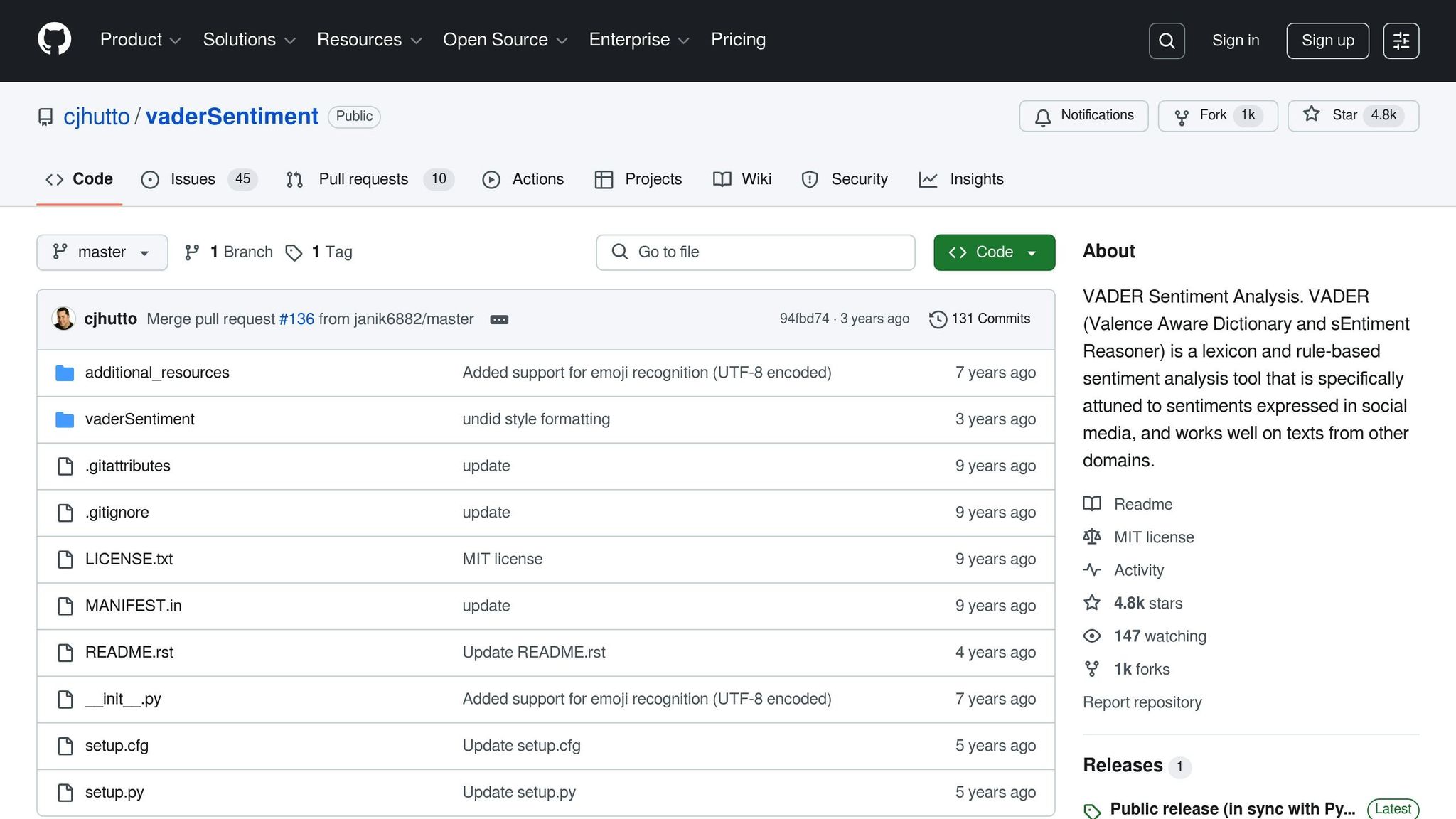

2. VADER (Valence Aware Dictionary for sEntiment Reasoner)

VADER is a lexicon- and rule-based tool designed to shine in analyzing social media content like Twitter and Reddit. In the cryptocurrency world, where these platforms heavily influence public sentiment, VADER's focus on such text is especially valuable. Let’s break down how it performs.

Accuracy in Sentiment Analysis

VADER's sentiment lexicon is no slapdash creation - it was validated by 10 experts and includes over 7,500 features with predefined valence scores, all drawn from a pool of 9,000 tokens. Research highlights its performance, with one study noting 60% accuracy when applied to tweets. Interestingly, removing Twitter-specific tags boosted the connection between sentiment scores and Bitcoin price trends during the COVID-19 period.

Adapting to Crypto-Specific Language

VADER’s lexicon is equipped to handle much of the acronyms, abbreviations, and slang often seen in crypto-related discussions. However, its fixed nature can be a drawback when it comes to understanding newly coined slang or the names of emerging crypto projects.

Speed in Real-Time Analysis

Thanks to its rule-based design, VADER processes sentiment data much faster than machine learning models. This speed is a major advantage when quick analysis is needed to predict cryptocurrency market swings based on public sentiment.

3. BERT-based Contextual Models

BERT-based models bring a new level of precision to event-specific sentiment analysis by understanding context in both directions, making them particularly effective in the fast-moving world of cryptocurrency markets.

Accuracy in Sentiment Analysis

BERT-based models excel at interpreting complex sentence structures and subtle contextual cues often found in crypto discussions. For instance, BERT can differentiate between long-term optimism and short-term caution in a phrase like, "Bitcoin is going to the moon, but not today." This level of detail results in sentiment scores that more accurately represent the market's mood.

This precision is critical when converting sentiment data into actionable trading insights. Additionally, BERT's ability to adapt to the ever-changing language and events in the crypto world further strengthens its utility.

Adapting to Crypto-specific Language and Events

A standout feature of BERT is its ability to learn from context, rather than depending on fixed dictionaries. As new cryptocurrency projects emerge and the language evolves, BERT keeps up by identifying patterns in how terms are used. For example, it understands that "diamond hands" signifies a strong commitment to holding assets, while "paper hands" suggests a tendency to sell under pressure - even without explicit training on these terms.

Beyond language, BERT is adept at processing complex narratives tied to events like regulatory changes, new partnerships, or technological breakthroughs. This allows it to capture the nuanced sentiments that often drive market behavior.

Real-time Processing Challenges

Despite its accuracy, BERT's complexity can slow down processing, which poses a challenge in markets where speed is essential. Handling streaming data from social media, news outlets, and forums requires balancing precision with efficiency to ensure sentiment analysis keeps up with rapid market changes.

To make real-time processing feasible, systems often rely on optimized versions of BERT or distributed computing setups. This ensures that sentiment insights are delivered quickly enough to inform trading decisions before market conditions shift.

Seamless Integration with Trading Platforms

Integrating BERT-driven sentiment analysis into trading platforms involves transforming sentiment scores into actionable strategies. Traders typically set thresholds for bullish, bearish, and neutral sentiment to trigger buy or sell signals. For example, a sentiment score above 0.7 might indicate a buying opportunity, while a score below 0.3 could suggest selling.

Risk management is equally important in these strategies. Position sizes are often tied to sentiment strength, with safeguards like stop-loss and take-profit levels in place to minimize the impact of false signals. Additionally, these systems connect directly to broker APIs, enabling automatic trade execution based on sentiment-driven signals, ensuring quick and efficient responses to market changes.

Ongoing monitoring and analysis are essential to fine-tune performance. By tracking how sentiment predictions align with actual market movements, traders can adjust thresholds and strategies based on historical data, ensuring that the system remains both accurate and effective.

4. Support Vector Machines (SVM)

Support Vector Machines (SVMs) stand out as a practical and mathematically clear method for sentiment analysis, complementing systems like AIQuant.fun's trading platform and contextual models such as BERT. SVMs excel at categorizing sentiment - positive, negative, or neutral - by establishing clear decision boundaries. Unlike many neural networks that demand extensive computational power, SVMs efficiently determine the optimal margins to separate these sentiment classes.

Accuracy in Sentiment Analysis

When configured correctly, SVMs can deliver highly accurate results in cryptocurrency sentiment analysis. The choice of kernel function - linear, polynomial, or radial basis function (RBF) - plays a crucial role. For example, linear kernels work well with high-dimensional text data, while RBF kernels are better suited for capturing more complex, non-linear relationships. Studies indicate that prediction accuracies for Artificial Neural Networks (ANNs) and SVMs reach 81% and 82%, respectively, outperforming traditional models like ARIMA. By incorporating optimization techniques such as Particle Swarm Optimization (PSO), SVMs can be further refined, creating hybrid models that improve forecasting performance. This adaptability allows SVMs to respond effectively to the fast-paced changes typical in cryptocurrency markets.

One of SVMs' strengths lies in their ability to manage high-dimensional feature spaces, which are often encountered in text analysis. For cryptocurrency discussions, SVMs can effectively filter out noise and focus on genuine market sentiment, even when training data is limited - a common challenge in fast-evolving markets.

Handling Crypto-Specific Events

While SVMs perform well in many scenarios, they face challenges with the rapidly changing language and events in the cryptocurrency world. Unlike contextual models that naturally adapt to slang and jargon, SVMs depend on manually engineered features to capture terms like "HODL", "diamond hands", or "moon." This reliance means frequent updates are necessary to keep up with evolving terminology. However, dynamic training regimes and regularization techniques can help SVMs address concept drift without requiring a full retraining process.

Striking the right balance between complexity and interpretability is essential. While more advanced kernels can capture intricate patterns in crypto-specific data, they also risk overfitting to short-term market trends, potentially reducing their effectiveness during unexpected events.

Real-Time Processing Capabilities

One of the key advantages of SVMs is their ability to classify data quickly after training. Unlike deep learning models that require significant computational resources for inference, SVMs can process sentiment in milliseconds, making them ideal for high-frequency trading scenarios. For instance, an SVM-based real-time classifier for detecting fraudulent transactions achieved an impressive F1 score of 0.89, showcasing its ability to handle streaming data efficiently while maintaining accuracy.

SVMs are well-suited for processing real-time data from sources like Twitter, Reddit, and news outlets. The success of these applications depends on efficient preprocessing pipelines that clean and normalize incoming text before classification. Hyperparameter tuning and feature selection are critical for balancing accuracy and speed, while techniques like cross-validation ensure optimal performance for rapid deployment.

Integration with Trading Platforms

SVMs bring practical benefits to trading platforms by combining speed, accuracy, and interpretability. For platforms like AIQuant.fun, integrating SVM-based sentiment analysis involves setting up automated data pipelines that continuously supply market sentiment data to the model. SVMs output probability scores, which can be converted into actionable trading signals using predefined thresholds.

The transparency of SVM decision boundaries makes it easier to understand why specific sentiment scores lead to certain trading actions. This interpretability also simplifies ongoing performance monitoring and fine-tuning of thresholds in automated systems. For example, sentiment confidence scores can be linked to position sizing, while stop-loss and take-profit levels help mitigate risks from false signals. Thanks to their efficiency and clear decision-making process, SVMs are a valuable tool for real-time cryptocurrency trading strategies, especially in volatile, event-driven markets.

sbb-itb-00c75f7

Strengths and Weaknesses

When it comes to predicting cryptocurrency volatility, each sentiment analysis method has its own strengths and limitations. Understanding these trade-offs is key to selecting the right approach.

Every method strikes a different balance between speed, accuracy, and ease of use.

AIQuant.fun is a standout platform that merges sentiment analysis with automated trading. It offers real-time integration and an interface that simplifies strategy implementation for traders. However, its performance heavily relies on the quality of the sentiment models it uses. This highlights an important point: no single method works perfectly across all market conditions.

VADER is a lexicon-based tool known for its speed and simplicity. It processes text quickly, making it a great fit for high-frequency trading. VADER can handle casual social media language, including emoticons and capitalization patterns, but it struggles with crypto-specific jargon and evolving slang. Terms like "HODL" or "diamond hands" often require manual updates to its dictionary, and it can miss subtle contextual meanings.

BERT-based models shine in their ability to understand complex language and context. They excel at adapting to new terminology and can differentiate between meanings based on context. Research confirms that machine learning models, including BERT, outperform traditional forecasting methods. However, these models come with a trade-off: they require significant computational power and longer processing times, which can be a hurdle for real-time applications unless supported by robust infrastructure.

Support Vector Machines (SVM) strike a balance between speed and accuracy. They classify sentiment data quickly after training and offer interpretable decision boundaries. However, their success depends on effective feature engineering and regular updates to remain relevant.

Here’s a quick comparison of these methods:

| Method | Accuracy | Real-Time Processing | Adaptability to Crypto | Ease of Integration |

|---|---|---|---|---|

| AIQuant.fun | High | Excellent | Good | Low |

| VADER | Moderate | Excellent | Limited | Low |

| BERT-based | High | Poor | Excellent | High |

| SVM | High | Good | Moderate | Moderate |

Research demonstrates that sentiment impacts crypto markets in nonlinear ways, which machine learning models capture more effectively. Traditional models like HAR often see minimal improvement with added sentiment data. On the other hand, methods like LightGBM, XGBoost, and LSTM show better predictive accuracy in 54.17% of cases when sentiment is factored in.

Speed is another critical factor. While VADER and SVM handle data quickly, BERT-based models take longer, making them less practical for real-time scenarios.

Adaptability also varies. For instance, during a study conducted from December 2021 to December 2022, tools like headlinehunter.ai successfully aggregated sentiment data from multiple sources. However, the effectiveness of the analysis depended heavily on the method used. BERT models adapted well to shifting language patterns, whereas lexicon-based tools required frequent manual updates to stay relevant.

Integration complexity is another consideration. VADER is easy to deploy, even for those with limited technical expertise. In contrast, BERT-based solutions demand specialized knowledge and infrastructure. SVMs fall somewhere in between, offering strong performance with moderate implementation requirements.

Ultimately, the right choice depends on your trading goals. High-frequency traders may prioritize speed over precision, while long-term investors might lean toward more computationally intensive models for their accuracy.

Conclusion

Choosing the right sentiment analysis method depends on your trading strategy and the technical tools at your disposal. Each approach offers distinct advantages tailored to different trading styles and needs.

For high-frequency traders, VADER is an excellent option. Its quick processing and straightforward implementation make it ideal for tracking immediate market reactions and scanning social media sentiment in real time.

Long-term investors and institutions, on the other hand, benefit from the accuracy of BERT-based models. These models excel at interpreting nuanced language and adapting to the ever-changing crypto landscape, though they require greater computational resources.

For those seeking a balance between advanced analytics and user-friendliness, AIQuant.fun is a standout choice. Its real-time integration and simple interface bring sophisticated sentiment analysis to traders without the need for deep technical expertise.

If you’re looking for a middle ground, Support Vector Machines offer solid performance with moderate complexity. They’re a good fit for traders who want more precision than lexicon-based methods but don’t have access to deep learning infrastructure.

Research consistently shows that incorporating sentiment data into volatility forecasting improves outcomes compared to traditional strategies. For U.S.-based cryptocurrency traders, a practical approach could involve starting with AIQuant.fun for accessible, sentiment-driven insights, supplementing with VADER for rapid monitoring, and scaling up to BERT-based models as trading activity grows.

Finally, no single sentiment analysis method works best for all cryptocurrencies or scenarios. The most effective traders combine multiple tools, using real-time updates and diverse data sources to refine their strategies. This blended approach captures a broader view of market sentiment while minimizing the risks of relying too heavily on any one method.

FAQs

What’s the difference between event-specific sentiment analysis and general sentiment analysis when predicting cryptocurrency market volatility?

Event-Specific vs. General Sentiment Analysis

Event-specific sentiment analysis zeroes in on the effects of particular events or announcements - like regulatory updates or major market developments - to anticipate short-term shifts in cryptocurrency volatility. By focusing on these specific triggers, it helps identify sudden market changes that might otherwise go unnoticed.

On the other hand, general sentiment analysis takes a broader approach, examining the overall market mood through sources like social media posts and trending news. While this provides a big-picture understanding of market behavior, it often misses the immediate reactions sparked by individual events. For traders aiming to react swiftly to sharp, event-driven market shifts, event-specific sentiment analysis offers a more targeted and timely advantage.

What are the benefits and challenges of using BERT-based models for real-time sentiment analysis in cryptocurrency trading?

BERT-Based Models in Real-Time Sentiment Analysis for Cryptocurrency Trading

BERT-based models bring a lot to the table when it comes to real-time sentiment analysis in cryptocurrency trading. Their ability to grasp complex and subtle language nuances makes them particularly effective at interpreting market sentiment. This, in turn, can help traders make better predictions about market trends and make more informed decisions.

That said, these models aren't without their challenges. They demand significant computational power, which can slow down real-time processing - a crucial factor in fast-moving markets like crypto. There's also the risk of overfitting to specific datasets, which can make it harder for the model to adapt to varying market conditions.

Even with these hurdles, BERT-based models are still a valuable asset. When paired with sentiment data from sources like social media and news outlets, they can significantly enhance forecasts of market volatility.

How can traders use sentiment analysis tools like VADER or SVM to improve their cryptocurrency trading strategies?

Traders looking to sharpen their cryptocurrency strategies can benefit from incorporating sentiment analysis tools like VADER and SVM. These tools help decipher market sentiment by analyzing data from sources such as social media, news outlets, and online forums.

VADER is a lightweight tool that works well for real-time sentiment analysis. It assigns sentiment scores, which traders can use to identify potential buy or sell signals. For instance, a sudden surge in positive sentiment might signal a good time to buy, while a spike in negative sentiment could indicate it’s time to sell. Meanwhile, SVM specializes in categorizing text data, making it useful for gauging overall market sentiment and fine-tuning trading strategies.

When used alongside technical or fundamental analysis, these tools can lead to more informed decisions. To simplify the process, platforms like AIQuant.fun offer advanced features, including real-time market tracking, automated trading strategies, and sentiment-based insights, making crypto trading more efficient and data-driven.