AI trading agents have transformed crypto trading. They analyze data, predict trends, and execute trades automatically. Here’s a quick overview of the top 7 AI trading platforms for 2025:

- AIQuant.fun - Offers dynamic strategy customization, multichain trading, and advanced risk management. Plans start at $89/month.

- Pionex GridMaster Pro - Built-in bots with no subscription fees and integrated exchange support.

- Cryptohopper Neural - Cloud-based platform with a strategy marketplace and manual control options. Plans start at $19/month.

- Bitsgap Quantum - Focuses on arbitrage and AI-driven GRID Bots for 25+ exchanges. Pricing starts at $23/month (billed annually).

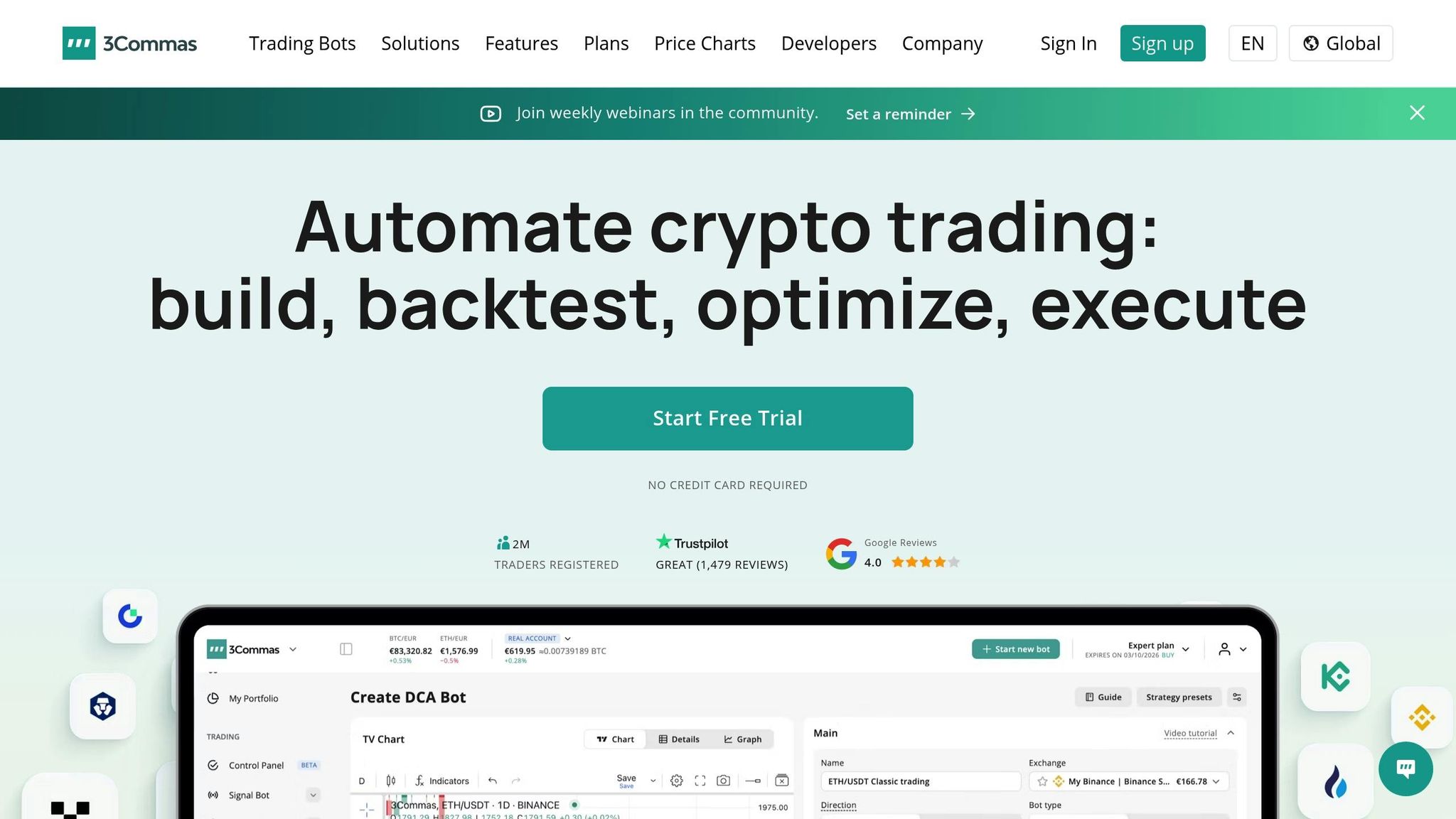

- 3Commas Hyper - Smart trading tools with custom signals and multi-exchange integration. Plans start at $49/month.

- HaasScript Ultra - Advanced scripting for custom strategies. Quarterly pricing starts at $254.

- Fetch.ai AEAs - Decentralized agents for automated trading on DEXs and DeFi platforms.

Quick Comparison

| Platform | Strategy Customization | Exchange Support | Risk Management | Starting Price |

|---|---|---|---|---|

| AIQuant.fun | Unlimited, auto-tuning | Multichain | Advanced tools | $89/month |

| Pionex | Pre-configured bots | Integrated exchange | Standard tools | Free |

| Cryptohopper | Strategy marketplace | 16+ centralized exchanges | Standard tools | $19/month |

| Bitsgap | AI-driven GRID Bots | 25+ exchanges | Enhanced orders | $23/month |

| 3Commas | Custom signals | 15+ exchanges | Advanced tools | $49/month |

| HaasScript | Custom scripting | 20+ exchanges | Custom algorithms | $254/quarter |

| Fetch.ai | Python framework | Decentralized exchanges | Decentralized security | Custom setup |

Each platform caters to different needs - whether you’re a beginner or an advanced trader. Choose based on your trading goals, customization needs, and risk tolerance.

Best AI Trading Bots of 2025? (INSANE Profit)

1. AIQuant.fun Autonomous Trading Suite

AIQuant.fun is designed to bring advanced AI trading tools to retail traders, offering capabilities once reserved for large financial institutions. This platform uses autonomous AI agents to analyze markets, perform technical analysis, and automate trades - all while removing the emotional biases that often cloud trading decisions. By making these tools accessible, AIQuant.fun empowers individual traders to compete effectively in the fast-paced world of crypto trading.

Trading Strategy Customization

One of the standout features of AIQuant.fun is its ability to adapt trading strategies dynamically, responding to market shifts instead of relying on rigid, pre-set rules. The platform offers three pricing plans to suit different levels of customization:

- Starter Plan ($89/month): Includes basic strategy deployment, support for one blockchain, and up to 10 open positions.

- Essentials Plan ($349/month): Adds manual tuning, exclusive strategies, copy-trading capabilities, and support for two blockchains with up to 50 open positions.

- Pro Plan ($1,299/month): Provides full automation with unlimited chains and positions, an auto strategy tuner that optimizes performance continuously, backtesting tools, and social integration for advanced strategy development.

These options allow traders to choose the level of control and automation that best fits their needs.

Data Processing Speed and Accuracy

AIQuant.fun’s AI agents are built for speed and precision, monitoring market conditions and analyzing multiple data streams in real time. This ensures trading decisions are always based on the most current data, giving users a competitive edge. In January 2025, the platform partnered with Alpha Liquid Terminal to further enhance its data processing capabilities. This collaboration gives AIQuant.fun access to specialized market insights and analytics, enabling its agents to execute more complex and data-driven strategies with improved liquidity and faster transactions.

"AIQuant.fun is committed to pushing the boundaries of what's possible in decentralized finance, and this partnership with Alpha Liquid Terminal is a major step forward. Together, we are not just simplifying access to DeFi but also creating smarter, more automated solutions for users around the world. By integrating autonomous AI agents and gamified financial growth, this collaboration strengthens our vision of building a truly open and efficient financial ecosystem." – Marlon Williams, the founder of AIQuant.fun

Beyond speed, the platform also emphasizes strong risk management to protect traders in volatile markets.

Risk Management Features

Effective risk management is a cornerstone of AIQuant.fun, especially in the unpredictable world of crypto trading. The Essentials and Pro plans include advanced protocols such as diversification, automated stop-loss orders, and position sizing to manage risks. For example:

- Each trade is capped at a potential loss of 1–2% of the trader’s capital.

- Stop-loss orders automatically close positions when prices hit predefined levels, limiting losses.

- Take-profit orders lock in gains once target profit levels are reached.

- Position sizes are adjusted based on market volatility, and trades are spread across multiple cryptocurrencies to reduce liquidity risks.

These measures ensure that traders can navigate market fluctuations with greater confidence.

Platform Integration and Supported Exchanges

AIQuant.fun supports multichain operations, enabling seamless trading across different blockchain networks. The partnership with Alpha Liquid Terminal enhances this functionality by improving pricing and transaction speeds across various ecosystems. This collaboration moves the platform closer to its goal of creating an open and efficient financial system for decentralized finance.

"Partnering with AIQuant.fun marks a pivotal moment for Alpha Liquid Terminal. We believe that the future of finance lies in decentralized systems that are easy to use, transparent, and efficient. By combining our expertise in asset management and analytics with AIQuant.fun's innovative AI-driven trading tools, we are confident this partnership will set new standards in digital finance and DeFAI accessibility." – Enzo Villani, Founder of Alpha Liquid Terminal

2. Pionex GridMaster Pro

Pionex GridMaster Pro brings advanced bot trading to retail investors, offering tools typically reserved for institutional traders. With 25% of crypto traders worldwide using it, this platform simplifies complex strategies by combining an exchange and bot trading service, removing the need for external integrations.

Trading Strategy Customization

Pionex provides 16 built-in trading bots tailored to various market conditions and trading preferences. Its standout feature, the Grid Trading Bot, lets users adjust grid size, order size, and price range to align with their risk levels and market predictions. For beginners, there are 12 free presets ready to go. Additionally, its arbitrage bots exploit price differences across exchanges, while grid trading strategies thrive in markets with minimal price movement.

Data Processing Speed and Accuracy

One of Pionex's strengths is its liquidity aggregation system, which pulls data from major exchanges like Binance and Huobi. As a top broker for Binance and a market maker for Huobi, Pionex ensures its bots access deep liquidity and real-time pricing. The platform also operates under a Money Services Business (MSB) license from FinCEN, reflecting a commitment to regulatory compliance and financial integrity.

Risk Management Features

Risk management is seamlessly integrated into Pionex's bot configurations. Traders can set stop-loss and take-profit levels, ensuring positions close automatically once they reach defined profit or loss thresholds. Grid trading bots also allow users to specify price ranges, preventing trades outside their comfort zone.

Platform Integration and Supported Exchanges

Pionex operates as a fully integrated exchange platform, eliminating the need for third-party API connections. This design reduces security risks tied to API key sharing and minimizes delays between trade signals and execution. Users can deposit funds directly into their Pionex accounts and start trading immediately. Plus, the platform is free to use with the Pionex exchange, making it an appealing option for those exploring automated trading without subscription fees. This integration highlights Pionex GridMaster Pro's focus on creating a streamlined, user-friendly experience, setting a high bar for automated crypto trading solutions.

3. Cryptohopper Neural

Cryptohopper Neural is an AI-powered trading platform designed to combine automation with manual control. It runs entirely in the cloud, operating 24/7, which makes it perfect for traders who want the convenience of automation while retaining the ability to fine-tune strategies. This setup aligns with the dynamic approaches seen in other platforms.

Trading Strategy Customization

The Strategy Designer 2.0 is at the heart of Cryptohopper's customization capabilities. This feature allows traders to create and deploy tailored strategies with ease. The platform’s AI evaluates multiple strategies at once, automatically selecting the best fit for current market conditions. For example, it can switch to trend-following strategies during volatile periods or lean on mean-reversion tactics when markets stabilize.

Traders can also build custom strategies using technical indicators, candlestick patterns, and external signals. For those looking for pre-built options, the marketplace offers a variety of AI-driven bots, both from Cryptohopper’s team and third-party developers, giving users a wide range of choices to suit their trading styles.

Platform Integration and Supported Exchanges

Cryptohopper integrates with over 16 major cryptocurrency exchanges, including Binance, Coinbase Pro, Kraken, and KuCoin. This allows traders to manage multiple accounts from one dashboard, connecting via API for seamless operation. It’s a handy feature for those juggling several accounts, especially in prop trading setups.

"CryptoHopper lets users copy expert strategies or build their own using drag-and-drop strategy designers. Great for automation and backtesting." - NUVO Technology

The platform also encourages a community-driven approach through its marketplace. Here, experienced traders can share, sell, or buy bot configurations, fostering collaboration and helping users - especially those with intermediate or advanced skills - expand their trading strategies.

Risk Management Features

Cryptohopper offers robust risk management tools, including trailing stop-loss orders and adjustable position sizing. Its AI uses pattern recognition to adapt risk parameters based on market volatility, ensuring trades stay within predefined risk levels.

For cautious traders, the platform provides backtesting and paper trading features. These tools allow users to validate their strategies in a simulated environment before going live.

Cryptohopper has four subscription plans to cater to various needs: Pioneer (Free), Explorer ($19/month), Adventurer ($49/month), and Hero ($99/month). Advanced traders seeking maximum customization and multiple bot deployments can opt for professional-grade features, priced at up to $129/month.

4. Bitsgap Quantum

Bitsgap Quantum is a crypto trading aggregator that connects users to over 25 cryptocurrency exchanges, including major names like Binance, Bitfinex, Kraken, and Coinbase Pro. Its primary focus lies in arbitrage and AI-driven recommendations, enabling traders to capitalize on price differences across exchanges. This automation highlights how tools can seize fleeting opportunities in the ever-changing crypto market.

Trading Strategy Customization

Bitsgap takes strategy customization to the next level with its tailored GRID Bots, guided by its AI Assistant. This feature analyzes a trader's cryptocurrency assets and offers personalized suggestions for configuring GRID Bots. Unlike purely algorithmic systems, Bitsgap combines pre-set rules with user-defined adjustments, allowing traders to fine-tune their strategies based on their preferences and market trends.

Traders can specify their investment amount, preferred term (short, mid, or long), and exchange options. The AI Assistant evaluates these inputs, recommends optimal GRID Bot setups, and even provides backtesting charts to assess potential performance using historical data.

On average, users employing Bitsgap's AI Assistant reportedly see 20% higher earnings compared to manual trading. This improvement stems from the AI's ability to create optimized bot portfolios, while the actual trades are executed by algorithmic bots.

Data Processing Speed and Accuracy

When it comes to arbitrage, speed is everything - and Bitsgap excels in this area. The platform can identify more than 20,000 arbitrage opportunities in just milliseconds, scanning across its supported exchanges. This capability is vital in the fast-moving cryptocurrency market, where price differences can vanish in seconds.

"Our platform and AI is capable of identifying and analyzing more than 20,000 arbitrage opportunities in just a couple of milliseconds within supported exchanges." - Max Kalmykov, CEO at Bitsgap

This rapid processing power allows traders to spot and act on opportunities that would be impossible to catch manually, creating a seamless and unified trading experience across multiple platforms.

Platform Integration and Supported Exchanges

Bitsgap simplifies trading by consolidating multiple exchange accounts into one dashboard. This integrated approach makes it easier to manage arbitrage trading, as users can execute trades across exchanges from a single interface.

The platform focuses on arbitrage trading, enabling users to exploit price differences between exchanges. Traders only need to ensure they have both cryptocurrency and fiat currency available on their respective exchanges. From there, they can execute trades with just one click via Bitsgap.

Risk Management Features

For those looking to practice before diving in, Bitsgap offers a demo account. This feature allows users to test arbitrage strategies across various exchanges without risking real money. It’s an excellent way to get familiar with the platform and refine trading techniques.

Bitsgap also provides three pricing plans to cater to different trading needs:

- Basic plan: $23/month (billed annually) – Includes AI Assistant, smart orders, and 30 days of backtesting.

- Advanced plan: $53/month – Adds futures bots, trailing stops, and 180 days of backtesting.

- Pro plan: $116/month – Includes take profit on Grid, AI Portfolio Mode, and 365 days of backtesting.

Each plan offers tools designed to enhance trading efficiency and help users maximize their strategies.

5. 3Commas Hyper

3Commas Hyper is a trading platform that caters to 22,000 crypto traders, handling over $6 million in daily trading volume and delivering an average of 15% monthly profits. It streamlines multi-exchange trading by integrating APIs for centralized management.

Trading Strategy Customization

3Commas stands out by offering traders the ability to fine-tune bot configurations to suit various market conditions. The platform includes tools like Smart Trade, DCA bots, and grid trading bots. Traders can enhance these bots with AI-driven custom signals using webhooks or APIs, creating advanced strategies that track technical indicators such as RSI, MACD, and Bollinger Bands. The bots are designed to shift seamlessly between momentum-based strategies for trending markets and grid trading setups for more stable, sideways markets. Additionally, dynamic exit rules adjust automatically during periods of low trading volume. These features work hand-in-hand with the platform’s execution tools, ensuring a cohesive trading experience.

Data Processing Speed and Accuracy

Beyond customization, 3Commas Hyper sharpens trade execution with tools like realistic backtesting and dynamic risk adjustments. The platform simulates trades by factoring in real-world fees and slippage, helping traders identify and address potential issues before committing actual funds. Its smart trading terminals also feature automated risk management, which modifies strategy parameters in response to market conditions like low liquidity, high volatility, or sudden price swings caused by breaking news.

Platform Integration and Supported Exchanges

The platform supports over 15 exchanges, including well-known names like Binance, Coinbase Pro, and KuCoin, and offers compatibility with both major cryptocurrencies and altcoins. For those interested in futures trading, 3Commas also integrates with platforms like Bybit and OKX.

Risk Management Features

To help traders mitigate risks, 3Commas includes essential safety tools such as daily drawdown limits, restrictions on open trades, stop-loss orders, and an adaptive recovery mode. The Smart Trade Terminal enables users to set stop-loss and take-profit orders simultaneously. Advanced features like Trailing Stop Loss, Trailing Take Profit, and Split Targets adjust dynamically as prices shift. Pricing options range from a free plan to a Pro plan at $37 per month (billed annually) or $49 monthly, and an Expert plan at $59 per month with annual billing or $79 on a month-to-month basis.

sbb-itb-61bccca

6. HaasScript Ultra

HaasScript Ultra offers a sophisticated AI-powered crypto trading platform designed for traders who want full control over their strategies. Developed by HaasOnline, a company established in 2014 and trusted for its professional-grade trading tools, the platform has earned an impressive 4.9/5 star rating. It’s built for those who demand precision and flexibility in their trading approach.

Trading Strategy Customization

At the heart of HaasScript Ultra is its proprietary scripting language, HaasScript. According to SourceForge, "HaasOnline developed HaasScript to be the world's most advanced crypto scripting language". This tool empowers traders to create intricate, rule-based strategies that adapt dynamically to market shifts - all without requiring deep programming skills. The platform supports various bot types, including trend-following, arbitrage, and scalping bots. Additionally, users can design custom technical indicators and automated algorithms to suit different market conditions.

Data Processing Speed and Accuracy

HaasScript Ultra stands out for its ability to process data quickly and accurately. It includes advanced backtesting capabilities, allowing users to test strategies against historical data and validate them in real-time without risking actual funds. This ensures traders can refine their strategies with confidence before putting them into action.

Risk Management Features

The platform integrates a suite of risk management tools to protect investments during volatile market conditions. Security is a key focus, with features like two-factor authentication (2FA) and secure API key integration to ensure safe connections to exchanges. Moreover, its robust backtesting functionality helps traders identify potential drawdowns and vulnerabilities, reducing the risk of unexpected losses when strategies go live.

Platform Integration and Pricing

HaasScript Ultra also provides a range of pricing plans to meet different trading needs. The Beginner Plan is priced at $254 per quarter, the Simple Plan costs $460 per quarter, and the Advanced Plan is available for $899 per quarter. The platform’s professional-grade features have received high praise from users, with Michal P. describing it as "the most professional software on the market". This strong endorsement highlights its appeal for traders looking for enterprise-level automation and strategy customization.

7. Fetch.ai AEAs

Fetch.ai's Autonomous Economic Agents (AEAs) combine decentralized AI and blockchain to automate trading strategies. These agents are designed to handle trades autonomously, using blockchain for secure and efficient execution. What sets AEAs apart is their ability to communicate, negotiate, and collaborate with one another through a shared language protocol.

Trading Strategy Customization

Fetch.ai offers its AEA Framework, a Python-based toolkit, for building and customizing agents. The platform also incorporates BlockAgent technology to monitor blockchain events. It supports three main trading functions:

- Copy Trading: Agents track specific smart contracts and execute trades based on predefined conditions, allowing users to replicate successful strategies.

- Portfolio Tracking: These agents monitor trades across liquidity pools and decentralized exchanges, providing real-time data to aid in decision-making.

- NFT Marketplace Monitoring: Agents filter and stream transactions from specific contracts, helping users stay informed about NFT order activity.

Users can easily deploy and manage their customized agents using the web-based AEA Manager, which simplifies the process and provides access to additional tools and services. This flexibility is further enhanced by Fetch.ai's ability to process data quickly and accurately.

Data Processing Speed and Accuracy

Fetch.ai has recently improved its infrastructure to handle data more efficiently. In 2025, the ASI Alliance expanded its decentralized AI computing framework, increasing validator nodes from 267 to 524. This upgrade boosted computing power by 143% and reduced processing costs by 37%. Additionally, the ASI-1 Mini, a Web3-native large language model, offers high performance while requiring only two GPUs, enabling agents to analyze market data with impressive speed.

Risk Management Features

Security and decentralized risk management are key priorities for Fetch.ai. The platform operates on its own Cosmos SDK blockchain, utilizing the CometBFT consensus mechanism. This decentralized setup eliminates central points of failure. By integrating blockchain and AI, Fetch.ai ensures secure, transparent execution through peer-to-peer data sharing.

Platform Integration and Supported Exchanges

Fetch.ai's tools are tailored for decentralized exchanges (DEXs), removing the need for centralized liquidity pools and automated market maker contracts. Its first major DeFi application simplifies automated trading for Uniswap users, enabling trades based on predefined conditions. Built on the Cosmos blockchain, Fetch.ai agents manage assets, execute trades, and interact seamlessly with various DeFi protocols, focusing on decentralized exchanges. Moreover, integration with SingularityNET's AGI capabilities has enhanced these agents, allowing them to handle complex tasks across multiple blockchain networks and provide broader market access.

Feature Comparison Table

The table below summarizes the features of each platform discussed, making it easier to compare and choose the ideal AI trading agent for your needs.

Trading Strategy Customization varies widely. AIQuant.fun offers unlimited strategies with auto-tuning, HaasScript Ultra allows for custom scripting, Cryptohopper Neural includes a strategy marketplace, Bitsgap Quantum enhances order types, 3Commas Hyper provides custom signals, Pionex features pre-configured bots, and Fetch.ai supports a Python-based framework.

Data Processing Speed plays a crucial role in fast-paced markets. By 2025, AI systems are expected to execute trades in nanoseconds, processing massive amounts of data. AIQuant.fun excels in real-time market analysis across multiple chains, while other platforms differ in speed depending on their technology and infrastructure.

Risk Management Features also differ in complexity. AIQuant.fun includes advanced tools across all paid plans. Pionex, Cryptohopper, and 3Commas offer standard tools like stop-losses, take-profits, and position sizing. HaasScript Ultra supports custom risk management algorithms, and Bitsgap incorporates enhanced order types for better control.

Platform Integration and Exchange Support varies greatly. AIQuant.fun offers multichain trading on its Pro plan. Fetch.ai AEAs emphasize decentralized exchanges like Uniswap and DeFi protocols. Other platforms focus on centralized exchanges, with varying levels of support.

| Platform | Strategy Customization | Exchange Support | Risk Management | Key Strength |

|---|---|---|---|---|

| AIQuant.fun | Unlimited strategies, auto-tuning | Multichain support | Advanced tools | Real-time market analysis |

| Pionex GridMaster Pro | Pre-configured bots | Major centralized exchanges | Standard tools | User-friendly experience |

| Cryptohopper Neural | Strategy marketplace | Major centralized exchanges | Standard tools | Strategy sharing |

| Bitsgap Quantum | Enhanced order types | 25+ exchanges | Enhanced order tools | Broad exchange coverage |

| 3Commas Hyper | Custom signals | 15+ exchanges | Standard tools | SmartTrade terminal |

| HaasScript Ultra | Custom scripting | 20+ exchanges | Custom algorithms | Programming flexibility |

| Fetch.ai AEAs | Python framework | Decentralized exchanges/DeFi | Decentralized security | Autonomous agents |

Each platform caters to different trading styles and priorities. If you're just starting, you might lean toward Pionex for its simplicity or AIQuant.fun for its guided features. On the other hand, experienced traders may appreciate the programming flexibility of HaasScript Ultra or the decentralized focus of Fetch.ai AEAs.

Conclusion

Picking the right AI trading agent can make or break your trading experience. The platforms we've explored cater to a wide range of traders - from novices just starting out to experienced pros looking for advanced tools.

AIQuant.fun shines with its powerful strategy customization and auto-tuning features, combined with real-time market analysis across multiple chains. This setup is designed to support fast and efficient decision-making. Pionex GridMaster Pro offers built-in bots and ultra-low maker/taker fees of just 0.05%. For those who love experimenting with strategies, Cryptohopper Neural's Algorithm Intelligence brings a unique edge by automating and combining multiple trading strategies, adapting to market shifts. If grid trading is your focus, Bitsgap Quantum is a strong contender, using its AI engine to adjust grids and strategies based on market trends. For DeFi enthusiasts, Fetch.ai AEAs stand out with their ability to automate DeFi trading through autonomous economic agents. These varied features reflect the article's central theme: using AI's precision to navigate volatile markets. Your ideal platform will depend on your trading style and goals.

Before you decide, take a moment to define your trading objectives and risk tolerance. As Warren Buffett wisely said, "The first rule is never lose money. The second rule is never to forget the first rule". Budget considerations are also key - some platforms charge flat fees, while others take a share of your profits. Start small to test the waters, and remember that AI bots still need your oversight. Even the smartest AI depends on the quality of its training data.

The crypto AI agent market has seen explosive growth, with its market cap jumping from $4.8 billion to $15.5 billion in Q4 2024 alone. This surge highlights the value these tools bring, but success ultimately hinges on selecting a platform that aligns with your needs and keeping realistic expectations about what automation can achieve.

Whether you're drawn to simplicity, advanced features, or specialized strategies, the platforms we've covered rank among the top AI trading options for 2025. Take the time to weigh each one against your goals - because the most expensive choice isn’t always the right one for your trading journey.

FAQs

How can AI trading agents enhance cryptocurrency trading strategies?

How AI Trading Agents Are Changing Cryptocurrency Trading

AI trading agents are transforming the way cryptocurrency trading is done. These tools use advanced algorithms to analyze massive amounts of market data in real time. Unlike traditional approaches, which often depend on past data and human judgment, AI can uncover patterns, trends, and opportunities that might slip past human traders. The result? Smarter, more data-driven decisions with better accuracy in anticipating market shifts.

What’s more, AI trading agents never sleep. They work around the clock, keeping a constant eye on market conditions and jumping on short-lived opportunities in the fast-moving crypto world. Over time, these systems also learn and adapt based on new data, fine-tuning their strategies to remain effective in a market that’s always evolving. For traders aiming to boost performance and increase profits, these tools are game-changers.

What should I look for in an AI trading platform for crypto in 2025?

When selecting an AI trading platform for cryptocurrency in 2025, there are a few important factors to keep in mind to ensure it meets your needs. Security should always come first - opt for platforms that provide features like two-factor authentication (2FA) and robust encryption to safeguard your investments.

Costs are another key aspect to evaluate. Be sure to review trading fees, withdrawal charges, and any potential hidden costs that could eat into your profits.

It’s also crucial to confirm that the platform supports the cryptocurrencies and trading pairs that match your trading strategy. For beginners, a user-friendly interface can make a world of difference, while advanced tools and dependable customer support are invaluable for tackling any issues that arise. Lastly, think about whether the platform integrates smoothly with other tools or services, as this can significantly boost your trading efficiency and overall experience.

How does AIQuant.fun help manage risks in the unpredictable crypto market?

AIQuant.fun utilizes cutting-edge AI tools to assist traders in navigating the unpredictable world of cryptocurrency trading. By analyzing real-time data and applying machine learning, its AI agents adjust to shifting market conditions and fine-tune trading strategies dynamically.

These AI agents incorporate crucial risk management methods such as diversification, position sizing, and stop-loss orders to help minimize losses during sudden market changes. They also conduct predictive and sentiment analyses, enabling traders to make informed, data-backed decisions that fit their financial objectives and comfort with risk.